[ad_1]

paypal is Fintech company It was founded in 1998. This company allows you to send and receive money online without the need for a bank account or credit card. PayPal is different from other online payment processing solutions because it uses an innovative technology called “peer-to-peer” (P2P) banking.

This means that PayPal transactions are processed directly between the two accounts without going through a bank. This makes PayPal much faster and more convenient than other online payment methods.

PayPal’s founders were Max Levchin, Peter Thiel, Luke Nosek, and Ken Howery. The company originally started as a way to process payments for eBay’s online auction site. Since then, he has become one of the world’s largest online payment processors with over 392 million users worldwide.

The technology behind PayPal is based on P2P banking, allowing money to be sent directly between two accounts without the need for a third party such as a bank or credit card company. PayPal was also one of the first companies to offer “single-click” payments, which makes online purchases much easier and faster.

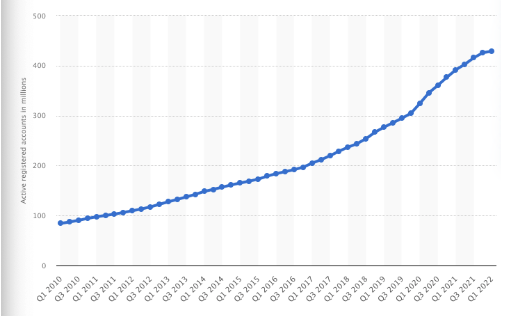

sauce: Statista’s PayPal Active User Accounts from Q1 2010 to Q1 2022

Between Q4 2021 and Q4 2020, PayPal’s active user base increased by 13%. In fact, PayPal’s multi-billion dollar annual revenue has grown from $17.77 billion in 2019 to $21.45 in 2020.

For example, you can use PayPal to make payments on eBay, Amazon, and other online retailers. It can also be used to send money to friends and family, or to donate to charity. In addition, it is the perfect payment solution for second secure banking for online games.You can use this banking method paypal casino games With a reputable online operator.

How do PayPal transactions work?

When you sign up for a PayPal account, you will need to provide your email address and create a password. Next, you’ll be asked to link your bank account or credit card to your PayPal account. Once this is done, you can pay using your PayPal balance, bank account, or credit card.

To make a payment, you need to enter the email address you want to send money to and the amount you want to send. The recipient will receive an email notification from PayPal with instructions on how to claim the money. The funds can be withdrawn to a bank account or he can keep them in his PayPal balance for future use.

PayPal uses a variety of security measures to protect your account, including encrypted passwords and two-factor authentication. You can also set a security question in case you forget your password. To protect your banking information, PayPal does not store your full bank account or credit card number on our servers.

Additionally, when you register to use PayPal with an e-commerce platform, online retailer, online casino, or money transfer service, you can also benefit from SSL encryption, firewall protection, and stringent security protocols on those websites. increase.

Cost-wise, PayPal isn’t the cheapest option when receiving money, but there are no fees on purchases. as a result, PayPal price Generally much lower than other payment processing solutions. For example, if you use your PayPal balance to make a purchase, there are no fees.

The standard cost is approximately 2.9% + $0.30 when purchasing using a bank account or credit card.It accepts Visa, MasterCard, and american expresswhich can be up to 3% + $0.30 per transaction.

[ad_2]